Municipal bond

| Financial markets |

|---|

|

|

Bond market |

|

Stock market |

|

Other markets |

Derivatives

Foreign exchange

|

Over-the-counter (off-exchange) |

|

Trading |

|

Related areas |

|

A municipal bond, commonly known as a Muni Bond, is a bond issued by a local government or territory, or one of their agencies. It is generally used to finance public projects such as roads, schools, airports and seaports, and infrastructure-related repairs.[1] The term municipal bond is commonly used in the United States, which has the largest market of such trade-able securities in the world. As of 2011, the municipal bond market was valued at $3.7 trillion.[2] Potential issuers of municipal bonds include states, cities, counties, redevelopment agencies, special-purpose districts, school districts, public utility districts, publicly owned airports and seaports, and other governmental entities (or group of governments) at or below the state level having more than a de minimis amount of one of the three sovereign powers: the power of taxation, the power of eminent domain or the police power.[3]

Municipal bonds may be general obligations of the issuer or secured by specified revenues. In the United States, interest income received by holders of municipal bonds is often excludable from gross income for federal income tax purposes under Section 103 of the Internal Revenue Code, and may be exempt from state income tax as well, depending on the applicable state income tax laws. The state and local exemption was the subject of recent litigation in Department of Revenue of Kentucky v. Davis, 553 U.S. 328 (2008).[4]

Unlike new issue stocks that are brought to market with price restrictions until the deal is sold, most municipal bonds are free to trade at any time once they are purchased by the investor. Professional traders regularly trade and re-trade the same bonds several times a week. A feature of this market is a larger proportion of smaller retail investors compared to other sectors of the U.S. securities markets. Some municipal bonds, often with higher risk credits, are issued subject to transfer restrictions.

Outside the United States, many other countries in the world also issue similar bonds, sometimes called local authority bonds or other names. The key defining feature of such bonds is that they are issued by a public-use entity at a lower level of government than the sovereign. Such bonds follow similar market patterns as U.S. bonds. That said, the U.S. municipal bond market is unique for its size, liquidity, legal and tax structure and bankruptcy protection afforded by the U.S. Constitution.

Contents

1 History

1.1 Early days (1800s)

1.2 Post Civil War

1.3 Modern times

2 Types of municipal bonds

2.1 General obligation and revenue bonds

2.2 Build America Bonds

3 Traditional issuance process

3.1 Municipal issuer

3.2 Municipal advisor

3.3 Bond counsel

3.4 Underwriter

3.5 Brokers

3.6 Bond holder (individual & syndicate)

4 Modern bond platforms

5 Characteristics of municipal bonds

5.1 Taxability

5.2 Interest Rates

5.3 Liquidity

5.4 Security

5.5 Denominations

6 Risk and insurance

7 Return Analysis

7.1 Comparison to corporate bonds

8 Statutory Regulation

8.1 History

8.2 Disclosures to investors

9 See also

10 Journals

11 References

History

Early days (1800s)

Historically, municipal debt predates corporate debt by several centuries—the early Renaissance Italian city-states borrowed money from major banking families. Borrowing by American cities dates to the nineteenth century, and records of U.S. municipal bonds indicate use around the early 1800s. Officially the first recorded municipal bond was a general obligation bond issued by the City of New York for a canal in 1812. During the 1840s, many U.S. cities were in debt, and by 1843 cities had roughly $25 million in outstanding debt. In the ensuing decades, rapid urban development demonstrated a correspondingly explosive growth in municipal debt. The debt was used to finance both urban improvements and a growing system of free public education.

Post Civil War

Years after the Civil War, significant local debt was issued to build railroads. Railroads were private corporations and these bonds were very similar to today's industrial revenue bonds. Construction costs in 1873 for one of the largest transcontinental railroads, the Northern Pacific, closed down access to new capital.[5] Around the same time, the largest bank of the country of the time, which was owned by the same investor as that of Northern Pacific, collapsed. Smaller firms followed suit as well as the stock market. The 1873 panic and years of depression that followed put an abrupt but temporary halt to the rapid growth of municipal debt.[6] Responding to widespread defaults that jolted the municipal bond market of the day, new state statutes were passed that restricted the issuance of local debt. Several states wrote these restrictions into their constitutions. Railroad bonds and their legality were widely challenged, and this gave rise to the market-wide demand that an opinion of qualified bond counsel accompany each new issue.

Modern times

When the U.S. economy began to move forward once again, municipal debt continued its momentum, which was maintained well into the early part of the twentieth century. The Great Depression of the 1930s halted growth, although defaults were not as severe as in the 1870s.[7] Leading up to World War II, many American resources were devoted to the military, and prewar municipal debt burst into a new period of rapid growth for an ever-increasing variety of uses. Today, in addition to the 50 states and their local governments (including cities, counties, villages and school districts), the District of Columbia and U.S. territories and possessions (American Samoa, the Commonwealth of Puerto Rico, Guam, the Northern Mariana Islands, and the U.S. virgin Islands) can and do issue municipal bonds. Another important category of municipal bond issuers which includes authorities and special districts has also grown in number and variety in recent years. The two most prominent early authorities were the Port of New York Authority, formed in 1921 and renamed Port Authority of New York and New Jersey in 1972, and the Triborough Bridge Authority (now the Triborough Bridge and Tunnel Authority), formed in 1933. The debt issues of these two authorities are exempt from federal, state and local governments taxes.[8]

Types of municipal bonds

General obligation and revenue bonds

Municipal bonds provide tax exemption from federal taxes and many state and local taxes, depending on the laws of each state. Municipal securities consist of both short-term issues (often called notes, which typically mature in one year or less) and long-term issues (commonly known as bonds, which mature in more than one year). Short-term notes are used by an issuer to raise money for a variety of reasons: in anticipation of future revenues such as taxes, state or federal aid payments, and future bond issuances; to cover irregular cash flows; meet unanticipated deficits; and raise immediate capital for projects until long-term financing can be arranged. Bonds are usually sold to finance capital projects over the longer term.

The two basic types of municipal bonds are:

General obligation bonds: Principal and interest are secured by the full faith and credit of the issuer and usually supported by either the issuer's unlimited or limited taxing power. In many cases, general obligation bonds are voter-approved.[1]

Revenue bonds: Principal and interest are secured by revenues derived from tolls, charges or rents from the facility built with the proceeds of the bond issue. Public projects financed by revenue bonds include toll roads, bridges, airports, water and sewage treatment facilities, hospitals and subsidized housing. Many of these bonds are issued by special authorities created for that particular purpose.[1]

Build America Bonds

Build America Bonds are a taxable municipal bond created under the American Recovery and Reinvestment Act of 2009 that carry special tax credits and federal subsidies for either the bond holder or the bond issuer. Many issuers have taken advantage of the Build America Bond provision to secure financing at a lower cost than issuing traditional tax-exempt bonds. The Build America Bond provision, which expired on January 1, 2011, was open to governmental agencies issuing bonds to fund capital expenditures.[9][10][11]

Traditional issuance process

Municipal bonds are securities that are issued for the purpose of financing the infrastructure needs of the issuing municipality. The financed infrastructure needs vary greatly but can include schools, streets and highways, bridges, hospitals, public housing, sewer, water systems, power utilities, and various public projects. Traditionally, municipal bonds are issued and sold to bond holders through a complex network of financial and legal professionals.

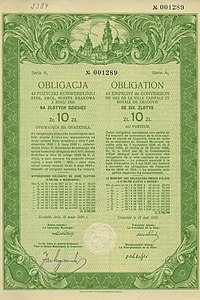

Municipal bond issued in 1929 by city of Kraków (Poland)

Municipal issuer

The public agencies raising money through bonds—such as states, cities, and counties—are known as municipal issuers. The ability to raise such funds is an exercise of the municipal issuer's buying power. In all bond issuances, the issuer serves as the focal point and the head of the financing team, and oversees the transformation of an idea for a project into an issuance. However, in some cases, the bond measure for a public project must first be approved by voters.[12]

The methods and procedures by which municipal debt is issued are governed by an extensive system of laws and regulations, which vary by state. Most bonds bear interest at either a fixed or variable rate of interest, which can be subject to a cap known as the maximum legal limit; some bonds may be issued solely at an original issue discount, or 0% coupon. If a bond measure is proposed in a local election, a Tax Rate Statement may be provided to voters, detailing best estimates of the tax rate required to levy and fund the bond. In cases where no election is held, depending on applicable local law, voters may be entitled to petition the approval to referendum (i.e., a public vote) within a specified period of time; bonds are typically not issued prior to the expiration of any such referendum period.

The issuer of a municipal bond receives a cash purchase price at the time of issuance in exchange for a promise to repay the purchasing investors, or their transferees, (the bond holder) over time. Repayment periods can be as short as a few months (although this is very rare) to 20, 30, or 40 years, or even longer. The issuer typically uses proceeds from a bond sale to pay for capital projects or for other purposes it cannot or does not desire to pay for immediately with funds on hand. Tax regulations governing municipal bonds generally require all money raised by a bond sale to be spent on capital projects within three to five years of issuance.[13] Certain exceptions permit the issuance of bonds to fund other items, including ongoing operations and maintenance expenses in certain cases, the purchase of single-family and multi-family mortgages, and the funding of student loans, among many other things.

Because of the special status of most municipal bonds granted under Section 103 of the Internal Revenue Code, which provides that the interest on such bonds is exempt from gross income, investors usually accept lower interest payments than on other types of borrowing (assuming comparable risk). This makes the issuance of bonds an attractive source of financing to many municipal entities, as the borrowing rate available to them in the municipal, or public finance, market is frequently lower than what is available through other borrowing channels.

Municipal advisor

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act, municipal advisors gained an increasingly important role in overseeing financial and legal circumstances surrounding the issuance of bonds.[14] The municipal advisor serves as a fiduciary for the municipal issue, taking care of all of the assets and finances involved in the issuance process. Legally, the advisor is obligated to represent the interests of the issuer and serve as a source of financial advice. This entails offering advice on structuring, selling, and promoting bonds, as well as serving as the central liaison between other members of the financial team, especially the underwriters and credit rating agency. Although municipal financial advisory services have existed for many years, municipal advisors have played a key role in the bond issuance process since the Securities and Exchange Commission enacted the Municipal Advisor rule in 2014, which prohibits certain communications between issuers and broker-dealers unless one of four exceptions is met, one being that the issuer has retained an Independent Registered Municipal Advisor ("IRMA").[12]

Bond counsel

After appointing a municipal advisor, bond issuers recruit a syndicate of legal professionals to serve as the financing team's bond counsel. The counsel works to verify the legal details of the issuance and ensure that the issuing agency is complying with all applicable laws and regulations. As the formal legal advisor for the deal team, the bond counsel will typically draft core documentation relating to bonds, including loan agreements, indentures, and other critical documents. Along these lines, the bond counsel is also tasked with reviewing and advising on any legal issues that might arise, and interpreting how tax laws affect the issuance. For instance, the bond counsel will decide if an issuance is exempt from state or federal taxes.[12]

Underwriter

Once a municipal advisor and bond counsel have been established, they will work together to identify an underwriter that will manage the distribution of the bonds. The underwriter is a broker-dealer that publicly administers the issuance and distributes the bonds. As such, they serve as the bridge between the buy and sell side of the bond issuance process. Underwriters connect issuers with potential bond buyers, and determine the price at which to offer the bonds. In doing so, most underwriters will assume full risk and responsibility for the distribution and sale of the bonds issued by the issuing agency. As such, underwriters play a central role in deciding the return and span of maturities, typically collect fees in exchange for their services. If the price is wrong, the underwriter is left holding the bonds.

Given the underwriter's role as a price marker, they also serve as a strategic partner to the issuing team, analyzing market conditions and trading, to help decide how and when the bonds should be sold. In many cases there will be a co-manager who works with the underwriter to help provide the capital to buy the issuance. In large issuances, the underwriter(s) will often put together a syndicate or selling group. This would consist of a group of bond salespeople who are skilled in the art of determining the right price for an issuance and a group of investors who’ll be willing to buy those bonds.[12]

Brokers

Brokers are the intermediate step between the underwriter and the actual bond holders, the cement-and-pavement financial professionals who answer orders for bond purchases. In most cases, underwriters will communicate and sell their maturities through multiple brokers. The broker seeks to distribute their bonds from the underwriter at a small percentage profit. Given the current legacy systems of the bond market, the distribution and sale of bonds is an exceptionally manual process requiring tremendous labor overhead and paperwork. As such, most municipal bond brokers only sell to high net worth individuals and organizations seeking to buy large quantities of bonds. Many of the people with direct ties to the impacted communities are therefore unable to contribute to their local governments, given little to no access to the profitable bond market.

Bond holder (individual & syndicate)

Municipal bond holders may purchase bonds either from the issuer or broker at the time of issuance (on the primary market), or from other bond holders at some time after issuance (on the secondary market). In exchange for an upfront investment of capital, the bond holder receives payments over time composed of interest on the invested principal, and a return of the invested principal itself (see bond).

Repayment schedules differ with the type of bond issued. Municipal bonds typically pay interest semi-annually. Shorter term bonds generally pay interest only until maturity; longer term bonds generally are amortized through annual principal payments. Longer and shorter term bonds are often combined together in a single issue that requires the issuer to make approximately level annual payments of interest and principal. Certain bonds, known as zero coupon or capital appreciation bonds, accrue interest until maturity at which time both interest and principal become due.

Modern bond platforms

Over the last decade many traditional and new market participants have begun to apply current technology solutions to the municipal market remedying many of the latent problems associated with many aspects of the municipal bond market. The emergence of products like small denomination municipal bonds, for example, is a result of new bond financing platforms. Such products also open up the muni market to middle-income buyers who otherwise couldn't afford the large, $5,000 minimum price in which bonds are typically bundled. The general idea with modern platforms is to leverage technology to make the market more responsive to investors, more financially transparent and ultimately easier for issuers and buyers. Many believe that, in doing so, more people will compete to buy muni bonds and thus the cost of issuing debt will be lower for issuers.[15]

Characteristics of municipal bonds

Taxability

One of the primary reasons municipal bonds are considered separately from other types of bonds is their special ability to provide tax-exempt income. Interest paid by the issuer to bond holders is often exempt from gross income for federal income tax purposes, as well as state or local taxes depending on the state in which the issuer is located, subject to certain restrictions. Bonds issued for certain purposes are subject to the alternative minimum tax as an item of tax preference.[1]

The type of project or projects that are funded by a bond affects the taxability of income received on the bonds. Interest earnings on bonds that fund projects that are constructed for the public good are generally exempt from federal income taxes, while interest earnings on bonds issued to fund projects partly or wholly benefiting only private parties, sometimes referred to as private activity bonds or PABs, may be subject to federal income tax. However, qualified private activity bonds, whether issued by a governmental unit or private entity, are exempt from federal taxes because the bonds are financing services or facilities that, while meeting the private activity tests, are needed by a government. See a list of those projects in Section 141 of the IRS Code.

Purchasers of municipal bonds should be aware that not all municipal bonds are tax-exempt, and not all tax-exempt bonds are exempt from all federal and state taxes. The laws governing the taxability of municipal bond income are complex. At the federal level they are contained in the IRS Code (Sections 103, 141-150), and rules promulgated thereunder. Additionally, special rules apply to certain types of investors (e.g., financial institution and property and casualty insurance companies) or in certain situations. For example, there is no IRS Code exemption for capital or other gains received from the sale of a municipal bonds and special rules apply for secondary market discount and original issue discount on municipal bonds. Each state will have its own laws governing what bonds, if any, are exempt from state taxes. For publicly offered bonds and most private placements, at the time of issuance a legal opinion will be provided indicating that the interest bonds are tax-exempt; these opinions do not customarily address collateral tax treatment. Offering documents, such as an official statement or placement memorandum, will contain further information regarding tax treatment of interest on the bonds. Investors should be aware that there are also post-issuance compliance requirements that must be met to ensure that the bonds remain tax-exempt. The IRS has a specific section of their website, www.irs.gov, devoted to tax exempt bonds and compliance with federal requirements.

Interest Rates

Municipal bonds have much higher interest rates compared to their FDIC-insured counterparts: CDs, savings accounts, money market accounts, and others. Over the last five years, the average interest rate return on municipal bonds has hovered around 4.5%,[16] while CDs of similar lengths have been at 1.5%.[17] Among other factors, this is a result of the longer, fixed return periods. Unlike stocks and other non-dated investments, municipal bonds have fixed rates and are far less liquid. As a general rule, municipal bonds with longer time to maturity have higher coupon rates.

Liquidity

Historically, municipal bonds have been one of the least liquid assets on the market. While stocks can be bought and sold within seconds on exchange platforms, given the current absence of widespread secondary market platforms for the exchange of stocks, municipal bonds are much harder to maneuver. At the same time, the minimum investment amounts for stocks are typically <$500 and about $1000 for CDs and money markets; in comparison, municipal bonds have higher average buy-in minimums of $5000. These minimum investment amounts previously barred many individuals from investing in bonds.

Security

The historical default rate for municipal bonds is lower than that of corporate bonds. The Municipal Bond Fairness Act (HR 6308),[18] introduced September 9, 2008, included a table giving bond default rates up to 2007 for municipal versus corporate bonds by rating and rating agency.

Denominations

Most municipal notes and bonds are issued in minimum denominations of $5,000 or multiples of $5,000.

Risk and insurance

The risk ("security") of a municipal bond is a measure of how likely the issuer is to make all payments, on time and in full, as promised in the agreement between the issuer and bond holder (the "bond documents"). Different types of bonds are secured by various types of repayment sources, based on the promises made in the bond documents:

General obligation bonds promise to repay based on the full faith and credit of the issuer; these bonds are typically considered the most secure type of municipal bond, and therefore carry the lowest interest rate.

Revenue bonds promise repayment from a specified stream of future income, such as income generated by a water utility from payments by customers.

Assessment bonds promise repayment based on property tax assessments of properties located within the issuer's boundaries.

In addition, there are several other types of municipal bonds with different promises of security.

The probability of repayment as promised is often determined by an independent reviewer, or "rating agency". The three main rating agencies for municipal bonds in the United States are Standard & Poor's, Moody's, and Fitch. These agencies can be hired by the issuer to assign a bond rating, which is valuable information to potential bond holders that helps sell bonds on the primary market.

Municipal bonds have traditionally had very low rates of default as they are backed either by revenue from public utilities (revenue bonds), or state and local government power to tax (general obligation bonds). However, sharp drops in property valuations resulting from the 2009 mortgage crisis have led to strained state and local finances, potentially leading to municipal defaults. For example, Harrisburg, PA, when faced with falling revenues, skipped several bond payments on a municipal waste to energy incinerator and did not budget more than $68m for obligations related to this public utility. The prospect of Chapter 9 municipal bankruptcy was raised by the Controller of Harrisburg, although it was opposed by Harrisburg's mayor.[19]

Return Analysis

Comparison to corporate bonds

Because municipal bonds are most often tax-exempt, comparing the coupon rates of municipal bonds to corporate or other taxable bonds can be misleading. Taxes reduce the net income on taxable bonds, meaning that a tax-exempt municipal bond has a higher after-tax yield than a corporate bond with the same coupon rate.

This relationship can be represented mathematically, as follows:

- rm=rc(1−t){displaystyle r_{m}=r_{c}(1-t),}

where

- rm = interest rate of municipal bond

- rc = interest rate of comparable corporate bond

- t = tax rate

For example, if rc = 10% and t = 38%, then

- rm=(10%)(100%−38%)=6.2%{displaystyle r_{m}=(10%)(100%-38%)=6.2%,}

A municipal bond that pays 6.2% therefore generates equal interest income after taxes as a corporate bond that pays 10% (assuming all else is equal).

The marginal tax rate t at which an investor is indifferent between holding a corporate bond yielding rc and a municipal bond yielding rm is:

- t=1−rmrc.{displaystyle t=1-{frac {r_{m}}{r_{c}}}.}

All investors facing a marginal rate greater than t are better off investing in the municipal bond than in the corporate bond.

Alternatively, one can calculate the taxable equivalent yield of a municipal bond and compare it to the yield of a corporate bond as follows:

- rc=rm(1−t){displaystyle r_{c}={frac {r_{m}}{(1-t)}}}

Because longer maturity municipal bonds tend to offer significantly higher after-tax yields than corporate bonds with the same credit rating and maturity, investors in higher tax brackets may be motivated to arbitrage municipal bonds against corporate bonds using a strategy called municipal bond arbitrage.

Some municipal bonds are insured by monoline insurers that take on the credit risk of these bonds for a small fee.

Statutory Regulation

History

The U.S. Supreme Court held in 1895 that the federal government had no power under the U.S. Constitution to tax interest on municipal bonds.[20] But, in 1988, the Supreme Court stated the Congress could tax interest income on municipal bonds if it so desired on the basis that tax exemption of municipal bonds is not protected by the Constitution.[21] In this case, the Supreme Court stated that the contrary decision of the Court 1895 in the case of Pollock v. Farmers' Loan & Trust Co. had been "effectively overruled by subsequent case law."

The Revenue Act of 1913 first codified exemption of interest on municipal bonds from federal income tax.[22]

The Tax Reform Act of 1986 greatly reduced private activities that may be financed with tax-exempt bond proceeds.[23]

IRC 103(a) is the statutory provision that excludes interest on municipal bonds from federal income tax.[24] As of 2004[update], other rules, however, such as those pertaining to private activity bonds, are found in sections 141–150, 1394, 1400, 7871.

Disclosures to investors

Key information about new issues of municipal bonds (including, among other things, the security pledged for repayment of the bonds, the terms of payment of interest and principal of the bonds, the tax-exempt status of the bonds, and material financial and operating information about the issuer of the bonds) typically is found in the issuer's official statement. Official statements generally are available at no charge from the Electronic Municipal Market Access system (EMMA) at http://emma.msrb.org operated by the Municipal Securities Rulemaking Board (MSRB). For most municipal bonds issued in recent years, the issuer is also obligated to provide continuing disclosure to the marketplace, including annual financial information and notices of the occurrence of certain material events (including notices of defaults, rating downgrades, events of taxability, etc.). Continuing disclosures is available for free from the EMMA continuing disclosure service.

See also

- Electronic Municipal Market Access

- S&P Municipal Bond Index

Journals

- Municipal Finance Journal

References

^ abcd "MSRB: About Municipal Securities". www.msrb.org. Retrieved 18 March 2018..mw-parser-output cite.citation{font-style:inherit}.mw-parser-output .citation q{quotes:"""""""'""'"}.mw-parser-output .citation .cs1-lock-free a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/6/65/Lock-green.svg/9px-Lock-green.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output .citation .cs1-lock-limited a,.mw-parser-output .citation .cs1-lock-registration a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/d/d6/Lock-gray-alt-2.svg/9px-Lock-gray-alt-2.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output .citation .cs1-lock-subscription a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/a/aa/Lock-red-alt-2.svg/9px-Lock-red-alt-2.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output .cs1-subscription,.mw-parser-output .cs1-registration{color:#555}.mw-parser-output .cs1-subscription span,.mw-parser-output .cs1-registration span{border-bottom:1px dotted;cursor:help}.mw-parser-output .cs1-ws-icon a{background:url("//upload.wikimedia.org/wikipedia/commons/thumb/4/4c/Wikisource-logo.svg/12px-Wikisource-logo.svg.png")no-repeat;background-position:right .1em center}.mw-parser-output code.cs1-code{color:inherit;background:inherit;border:inherit;padding:inherit}.mw-parser-output .cs1-hidden-error{display:none;font-size:100%}.mw-parser-output .cs1-visible-error{font-size:100%}.mw-parser-output .cs1-maint{display:none;color:#33aa33;margin-left:0.3em}.mw-parser-output .cs1-subscription,.mw-parser-output .cs1-registration,.mw-parser-output .cs1-format{font-size:95%}.mw-parser-output .cs1-kern-left,.mw-parser-output .cs1-kern-wl-left{padding-left:0.2em}.mw-parser-output .cs1-kern-right,.mw-parser-output .cs1-kern-wl-right{padding-right:0.2em}

^ "The State of the Municipal Securities Markets". Retrieved 18 October 2014.

^ Commissioner vs. Shamberg's Estate, 144 F.2d 998 (2nd. Cir. 1944), cert. denied, 323 U.S. 792 (1945)

^ Greenhouse, Linda (2008-05-20). "Court Upholds Tax Exemptions for Municipal Bonds". The New York Times. ISSN 0362-4331. Retrieved 2017-10-07.

^ Ripley, William (1915). Railroads: Finance & Organization. New York: Longmans, Green, & Co. pp. 106–107. ISBN 1-58798-074-6.

^ O'Hara, Neil (2012). The Fundamentals of Municipal Bonds. Hoboken, NJ: John Wiley & Sons, Inc. p. 55. ISBN 978-1-118-16682-6.

^ Joffee, Marc. "The Safety of State Bonds". Retrieved 13 November 2012.

^ Temal, Judy Wesalo (2001). The Fundamentals of Municipal Bonds: The Bond Market Association. John Wiley and Sons, Inc. p. 49. ISBN 0-471-39365-7.

^ DerivActiv MuniMarket Pulse. "Mier of Loop Capital Says an Issuer 'Can Get Access to All These New Buyers by Going Taxable'[permanent dead link]" Retrieved on May 23, 2009

^ Internal Revenue Service. "IRS Issues Guidance on New Build America Bonds" Retrieved on May 23, 2009.

^ Rosenberg, Stan. "Louisiana Joins Build America Bond Parade With $121 Million" Wall Street Journal. May 27, 2009. Retrieved on May 31, 2009.

^ abcd "The Public Finance Deal Team" (PDF).

^ "Tax regulations". Retrieved 18 October 2014.

^ "Dodd-Frank Act Rulemaking: Municipal Securities". www.sec.gov. Retrieved 2016-08-24.

^ "Startups Seek to Democratize the Muni Market". www.governing.com. Retrieved 2017-06-12.

^ "Muni Bonds Are More Volatile Than You May Think". Retrieved 2016-08-24.

^ "FDIC: Weekly National Rates and Rate Caps". www.fdic.gov. Retrieved 2016-08-24.

^ "House Report 110-835 - MUNICIPAL BOND FAIRNESS ACT". Retrieved 18 October 2014.

^ "Archived copy". Archived from the original on 2011-07-14. Retrieved 2010-09-03.CS1 maint: Archived copy as title (link)

^ Pollock v. Farmers' Loan & Trust Co., 157 U.S. 429, 15 S. Ct. 673, 39 L. Ed. 759 (1895)

^ South Carolina v. Baker, 485 U.S. 505, 108 S. Ct. 1355, 99 L. Ed. 2d 592 (1988)

^ Revenue Act of 1913

^ Tax Reform Act of 1986

^ IRC 103(a).